Payback Period for Startups: What It Is, How to Calculate It, and Why It Matters

By Lior Ronen | Founder, Finro Financial Consulting

Startups often talk about growth in terms of new users, bigger rounds, or higher revenue. Investors, however, see growth through a different lens, how efficiently that growth pays for itself.

The payback period shows exactly that.

It measures how long it takes for a startup to recover its customer acquisition cost (CAC) through the gross profit generated by those customers. A shorter payback means your growth engine funds itself faster. A longer payback means every new customer strains your cash position.

Understanding payback period matters because it connects marketing, pricing, and profitability into a single metric. It reveals whether your model scales sustainably or burns through capital with every sale.

In the next section, we’ll define what payback period really measures and walk through how to calculate it correctly for different types of tech startups — from SaaS and AI to fintech, marketplaces, and cybersecurity.

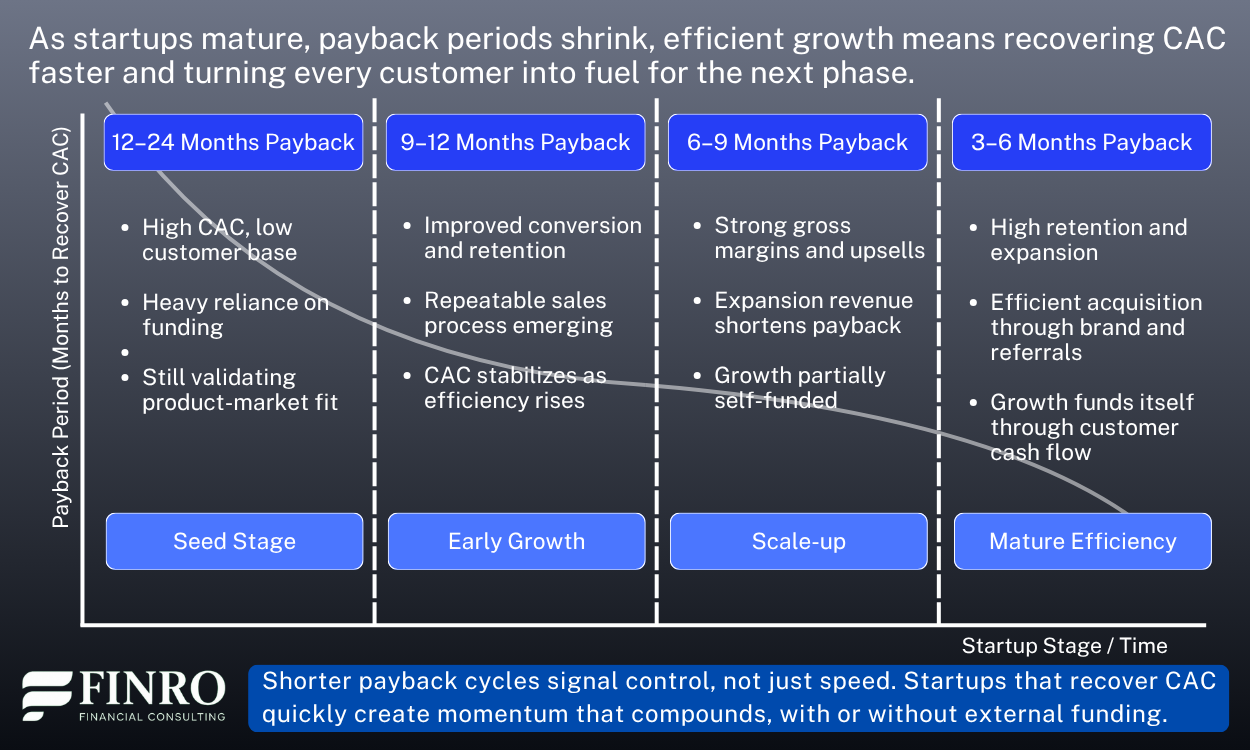

The speed at which a startup recovers customer acquisition costs defines its ability to grow without constant fundraising. A predictable payback period reflects an efficient balance between acquisition, retention, and monetization. In tech, these dynamics vary — API and fintech models recover fast through recurring use, while EdTech, cyber, and biotech take longer but build lasting relationships that compound over time. The key isn’t chasing the shortest recovery but building a repeatable, data-driven system that turns every new customer into a self-sustaining source of growth.

What Is Payback Period?

The payback period measures how long it takes for a company to recover the cost of acquiring a customer. It links sales efficiency, gross margin, and customer retention into one metric that shows how quickly growth becomes self-funding.

The basic formula is straightforward:

Payback Period = CAC ÷ Gross Margin per Customer (or per Month)

In plain terms, if it costs you $1,200 to acquire a customer and you make $100 in gross profit per month from that customer, your payback period is 12 months. After those 12 months, each additional dollar from that customer contributes to profit and cash flow.

Payback period connects two metrics you already know: CAC and gross margin. It tells you when the money you spend to acquire customers returns to your account. That is why investors use it as a quick reality check for scalability.

Let’s take a simple example.

A SaaS startup spends $60,000 a month on sales and marketing and gains 120 new paying customers. CAC equals $500. Each customer generates $150 in monthly recurring revenue at a 75 percent gross margin, or $112.50 per month in gross profit. The payback period is $500 divided by $112.50, which equals roughly 4.4 months.

Now compare that with an AI startup that relies on high compute costs. Their CAC might still be $500, but gross margin is only 50 percent because of infrastructure expenses. At $150 monthly revenue and $75 in gross profit per customer, the payback period extends to about 6.7 months.

The math is simple, but the insight is powerful. The faster you recover CAC, the faster you can reinvest in new growth without relying on external funding.

Why Payback Period Matters for Startups?

Payback period isn’t just a financial metric. It’s a signal of efficiency. It shows how fast your business can recover its customer acquisition costs and start compounding value. For early-stage startups, that speed can determine whether growth is sustainable or dependent on external capital.

A shorter payback period means your business reinvests cash faster. It frees up working capital for hiring, product development, or marketing without constantly relying on new funding rounds. For investors, that’s a sign of resilience. It means each dollar spent on growth returns to the system quickly.

The connection to burn rate and runway is direct.

Startups with slow payback cycles burn cash for longer before seeing returns, shortening the runway and increasing fundraising pressure. By contrast, efficient startups, especially those with strong gross margins, extend their runway with every customer they onboard.

Take SaaS or AI infrastructure startups, for example. When customer acquisition costs are high but recurring revenue is sticky, the payback period might initially be 12–18 months. Once onboarding automates and upsells kick in, it can drop below 9 months, unlocking self-funded growth.

In Fintech, where transaction volumes scale faster, efficient models can reach payback within a single quarter, turning each new customer into an immediate cash generator.

Ultimately, investors see the payback period as a test of your business model’s leverage. Fast payback isn’t just about cost control. It’s proof that your company can grow without burning through capital.

How Payback Connects CAC and LTV?

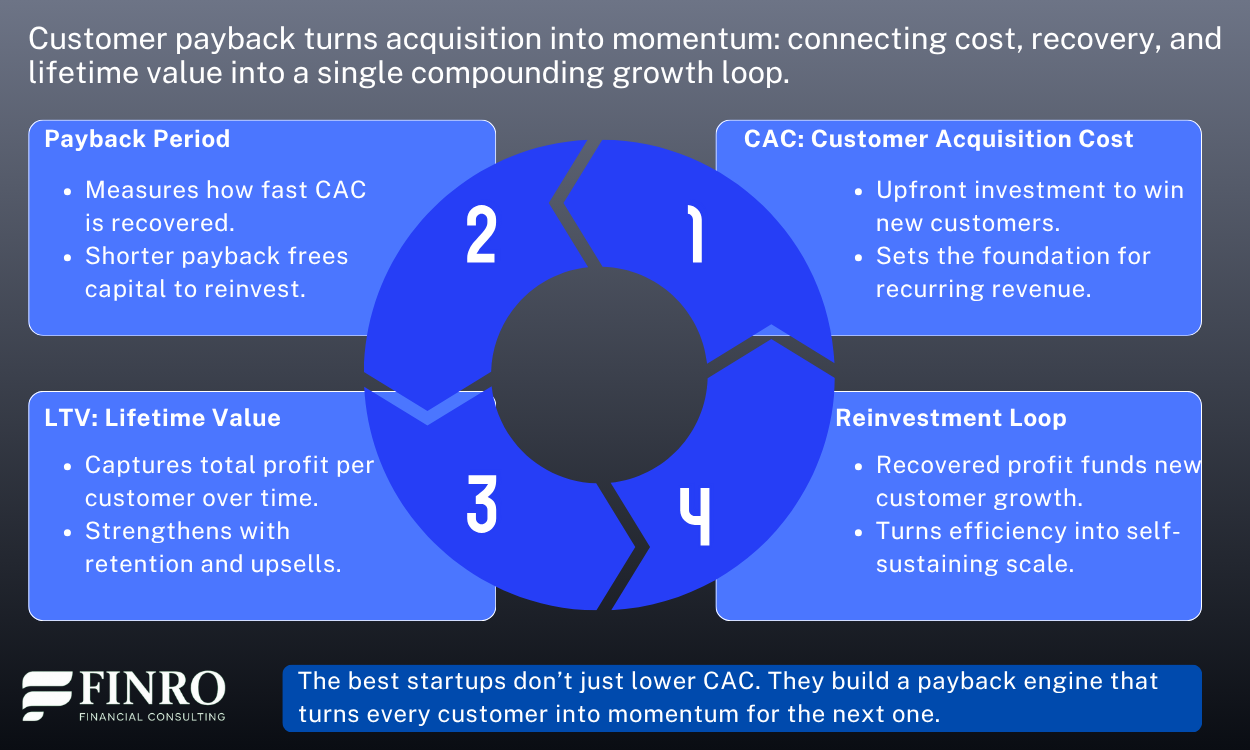

The payback period is the missing bridge between CAC (what it costs to acquire a customer) and LTV (how much that customer is worth over time).

It measures the speed at which your acquisition cost transforms into real, repeatable profit, showing whether growth is sustainable or debt-driven.

When your CAC is high and your payback period exceeds a year, it means your startup relies on external funding to sustain growth. You’re buying customers faster than they can pay you back.

As your payback period shortens, CAC becomes self-liquidating. Every dollar invested in acquisition comes back faster, freeing capital to reinvest in marketing, product, and expansion.

In SaaS and AI startups, payback efficiency often depends on product adoption and retention. For example, an API platform that charges per call may recover CAC within four months once usage stabilizes, while a complex B2B SaaS product with a six-month onboarding cycle might take a year to recover.

In Fintech or Cybersecurity, recurring usage and sticky integrations can bring payback below six months — investors view that as a mark of operational excellence and defensibility.

The key is not to chase the lowest payback number, but to optimize it relative to your business model and sales cycle.

A company with an eight-month payback but 120 % NRR is often healthier than one with a four-month payback and 90 % NRR. Payback doesn’t replace CAC or LTV; it tells you how efficiently the two connect — how fast your model turns cost into compounding value.

Payback Benchmarks Across Tech Niches

Payback periods vary widely across tech sectors because of how each business acquires customers, recognizes revenue, and scales margin. A short payback doesn’t always mean better — what matters is whether it fits the company’s model, market motion, and cash cycle.

In EdTech, payback is often 12 to 18 months. Customer acquisition tends to be seasonal, linked to academic cycles, and heavily driven by brand trust. Institutions and schools have long sales processes, but once onboarded, retention can stretch for years. That makes a moderate payback perfectly healthy.

Biotech software platforms that sell data analytics or lab automation tools usually see 18 to 30-month paybacks. These customers have long validation and procurement cycles, and gross margins are strong once adoption starts. What matters more here is deal renewal and expansion rather than fast initial recovery.

In Fintech, payback can range from 9 to 15 months, depending on whether the product targets consumers or enterprises. B2C lending or payments platforms may need heavy upfront marketing to earn trust, but recurring transaction volume quickly repays CAC. Enterprise-focused platforms often recover costs slower but enjoy higher LTVs once integrated.

Cybersecurity companies average around 12 months when selling SaaS security or identity tools, though early-stage players may reach 18 months until brand credibility builds. Once embedded, these solutions have high stickiness and renewal rates, compressing payback over time.

For API infrastructure startups, payback is often under 9 months once developer adoption accelerates. Usage-based pricing and high gross margins create a direct path from usage to recovery — the model naturally scales as consumption grows.

Finally, Marketplaces and Platforms can see wide variance: from 6 months for high-velocity B2C platforms to 24 months for niche B2B marketplaces. Their payback depends on liquidity — how fast supply and demand reach balance. As transaction volume compounds, recovery accelerates rapidly.

Across all these sectors, the key question isn’t just how fast you recover CAC, but how predictably. Predictable payback is what investors value most because it turns customer acquisition from a gamble into a repeatable growth engine.

| Niche | Observed payback trend | Finro insight |

|---|---|---|

| API Infrastructure | Often under a year once usage scales | High margin, usage based models recover fast as adoption compounds |

| Fintech | Around 9 to 15 months depending on product type | Recurring transactions shorten recovery once users trust the platform |

| Cybersecurity | Roughly one year at scale | Strong retention and renewals improve efficiency after brand validation |

| EdTech | Around a year or slightly longer | Seasonal acquisition balanced by long institutional retention |

| Biotech Software | Typically 18 to 30 months | Long procurement cycles offset by durable multi year contracts |

| Marketplaces | Varies widely from 6 to 24 months | Early imbalance between supply and demand stretches recovery early on |

Note: Indicative ranges based on Finro market experience and publicly available SaaS benchmarks.

Short vs. Long Payback: What It Really Signals

Many founders see short payback periods as a universal good. In reality, both short and long payback profiles can be healthy — depending on the startup’s model, stage, and growth strategy.

A short payback period (under 12 months) signals strong capital efficiency and rapid monetization. API startups, cybersecurity platforms, and mature fintech products often fall into this category. Their customers convert quickly, margins are high, and recurring revenue builds stability early. These companies can fund growth with less external capital, which investors love because it reduces dilution and dependency on new rounds.

But longer payback periods aren’t necessarily a red flag. In capital-intensive or complex industries like biotech, enterprise SaaS, or B2B marketplaces, payback can take 18–30 months — and still be perfectly rational. These models often involve long procurement cycles, implementation, or regulatory approvals. Once onboarded, however, these customers stay for years, generating large LTV multiples that more than justify the initial delay.

The real insight isn’t whether payback is short or long — it’s whether it’s improving predictably as the business scales. If recovery time shortens with experience, efficiency, and retention, the model compounds. If it stretches out despite growth, the startup is leaking capital somewhere in its funnel.

The best founders use payback not as a vanity metric, but as a signal of business maturity. It shows whether customer acquisition and retention are synchronized — and whether growth can sustain itself without burning through cash.

Summary

Payback period is one of the few startup metrics that truly reveals how efficiently a business converts growth into cash. It connects every dollar spent on acquisition with the moment it starts generating real profit. When payback shortens predictably, founders gain control — over fundraising, burn rate, and growth pace. When it stretches, it signals friction between product, pricing, and retention that needs to be fixed before scaling further.

Across tech sectors, payback behaves differently. API infrastructure and fintech startups often recover acquisition costs within a year, driven by high-margin usage models and transaction volume. Cybersecurity and EdTech companies take slightly longer due to slower enterprise or institutional cycles but benefit from higher retention. Biotech software and marketplaces may need up to two years, but their stickiness and deal size often turn those long recoveries into compounding returns. Predictability, not speed, defines sustainability.

At Finro, we help startups build financial models that capture this reality — showing investors not just what your numbers are, but how they behave. From modeling CAC and payback curves to designing investor-ready forecasts, we turn your metrics into a growth story that makes sense.

If you want a financial model that reflects how your business actually scales, talk to us.

Key Takeaways

Payback measures growth efficiency. It shows how fast customer acquisition investments return to the business as gross profit.

Predictability beats speed. A consistent recovery timeline matters more than an impressively short one.

Each niche has its rhythm. API and fintech recover fast; biotech and marketplaces take longer but retain better.

Payback connects CAC and LTV. It’s the bridge between acquisition efficiency and long-term value creation.

Investors read it as maturity. A predictable payback curve signals operational discipline and strategic control.

-

Most efficient tech startups recover CAC within 12–18 months, though this varies by niche and pricing model.

-

Divide total customer acquisition cost by monthly gross profit per customer until CAC is fully recovered.

-

Not necessarily. In industries with high retention and large deal sizes, longer payback can still be very profitable.

-

Payback sits between them. It measures how fast CAC converts into recovered profit before LTV compounds.

-

Because it shows how much capital efficiency your business has, and whether growth is sustainable without constant fundraising.