Understanding Net Revenue Retention (NRR): The Real Indicator of Sustainable Growth

By Lior Ronen | Founder, Finro Financial Consulting

Revenue growth looks great on paper, but it doesn’t tell you whether your product is actually getting stronger. A startup can double its top line while quietly losing customers, or barely grow new sales while expanding the value of every existing account.

That’s why investors pay close attention to Net Revenue Retention (NRR).

NRR measures how your existing customer base behaves over time, whether they stay, leave, or spend more. It reflects retention, expansion, and contraction all in one number.

When your NRR is above 100%, your revenue is growing even without new customer acquisition. When it falls below 100%, it signals product, pricing, or churn issues that may be slowing scalability.

For tech startups, especially in SaaS, AI, or Fintech, NRR is one of the clearest indicators of product-market fit and long-term efficiency.

It connects what happens inside your product (engagement, upsells, and renewals) to the financial performance investors care about most.

In other words, NRR shows whether your growth is self-sustaining or acquisition-dependent.

Sustainable growth comes from retaining and expanding the value of existing customers. Startups that invest in measurable product value, pricing alignment, and proactive retention create compounding growth that investors trust

What Is Net Revenue Retention (NRR)?

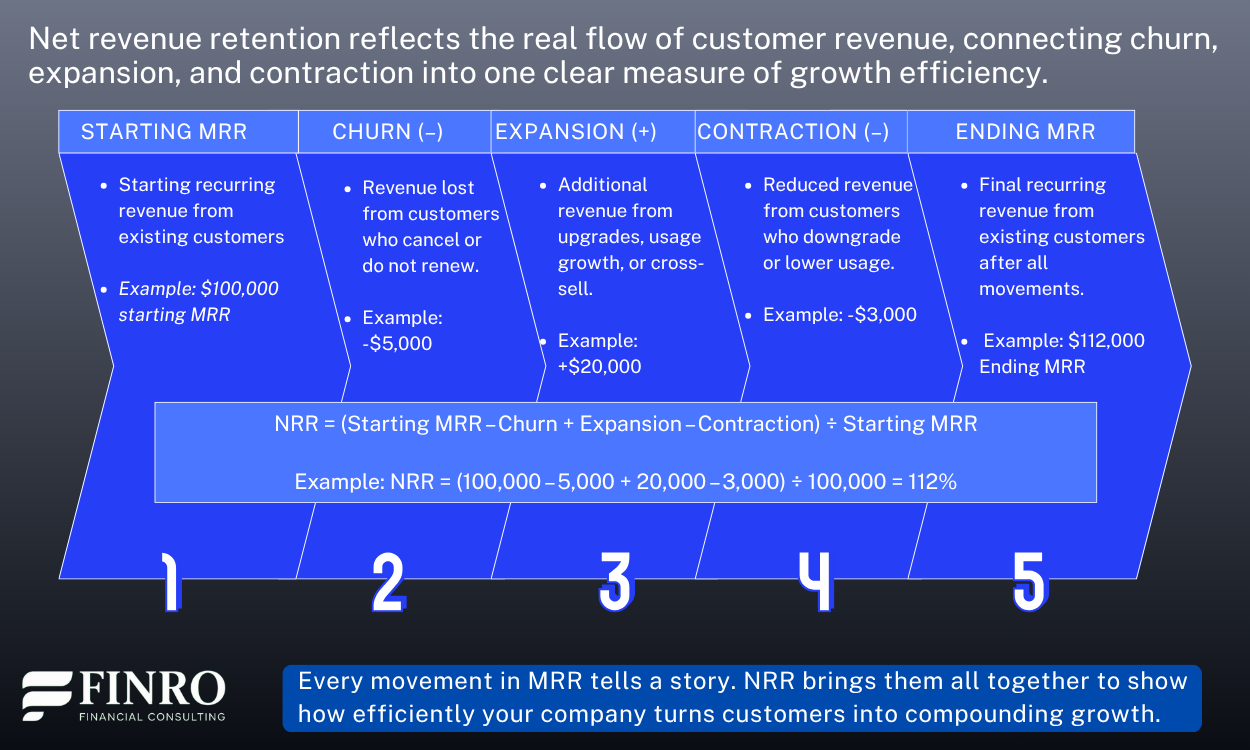

Net Revenue Retention (NRR) measures how your existing customers evolve over time — whether they stay, expand, or churn. It tells you how much recurring revenue you keep and grow from your current base without adding new customers.

Formula:

NRR = (Starting MRR + Expansion – Contraction – Churn) ÷ Starting MRR × 100

A company with 100% NRR retains all its revenue from existing customers. Anything above 100% indicates that customers are spending more than they did last period, which is a powerful signal of product-market fit and value creation. Below 100% means you’re losing ground, and even strong new customer growth may only be masking churn or downgrades.

Let’s look at a simple SaaS example:

A startup begins the quarter with $100,000 in Monthly Recurring Revenue (MRR) from existing customers.

Customers expand usage or upgrade plans, adding $25,000 in expansion MRR.

Some customers downgrade, causing $5,000 in contraction.

A few churn completely, reducing MRR by $10,000.

NRR = (100,000 + 25,000 – 5,000 – 10,000) ÷ 100,000 × 100 = 110%

That 110% tells investors something important: the company is growing revenue even if it doesn’t add a single new customer. In other words, the product and customer experience are doing the heavy lifting.

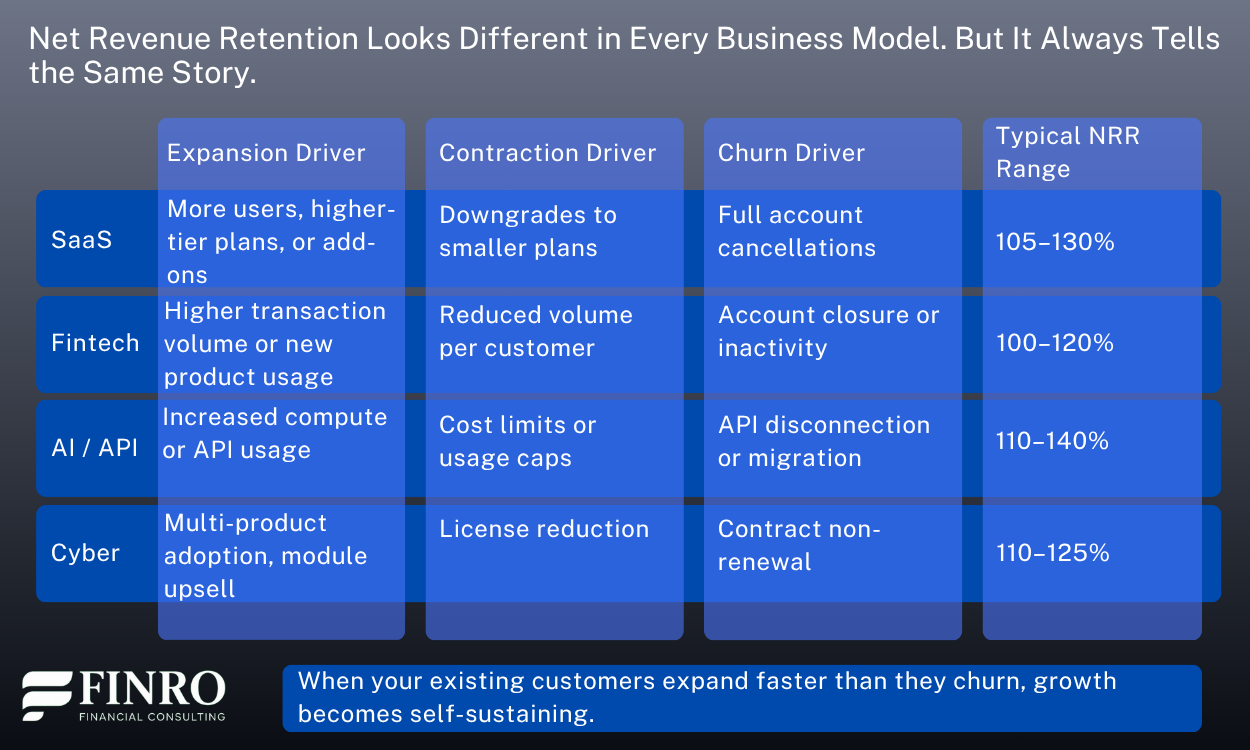

But the same number can look very different depending on your business model.

In SaaS, expansion might come from more seats or higher tiers.

In Fintech, it could be driven by higher transaction volume.

In AI or API-based startups, by increased compute or usage.

In marketplaces, by more active vendors or growing GMV.

That’s why NRR isn’t a “one-size-fits-all” metric, it’s a reflection of how each business model creates, retains, and compounds value over time.

How to Improve NRR: The Practical Levers That Actually Work

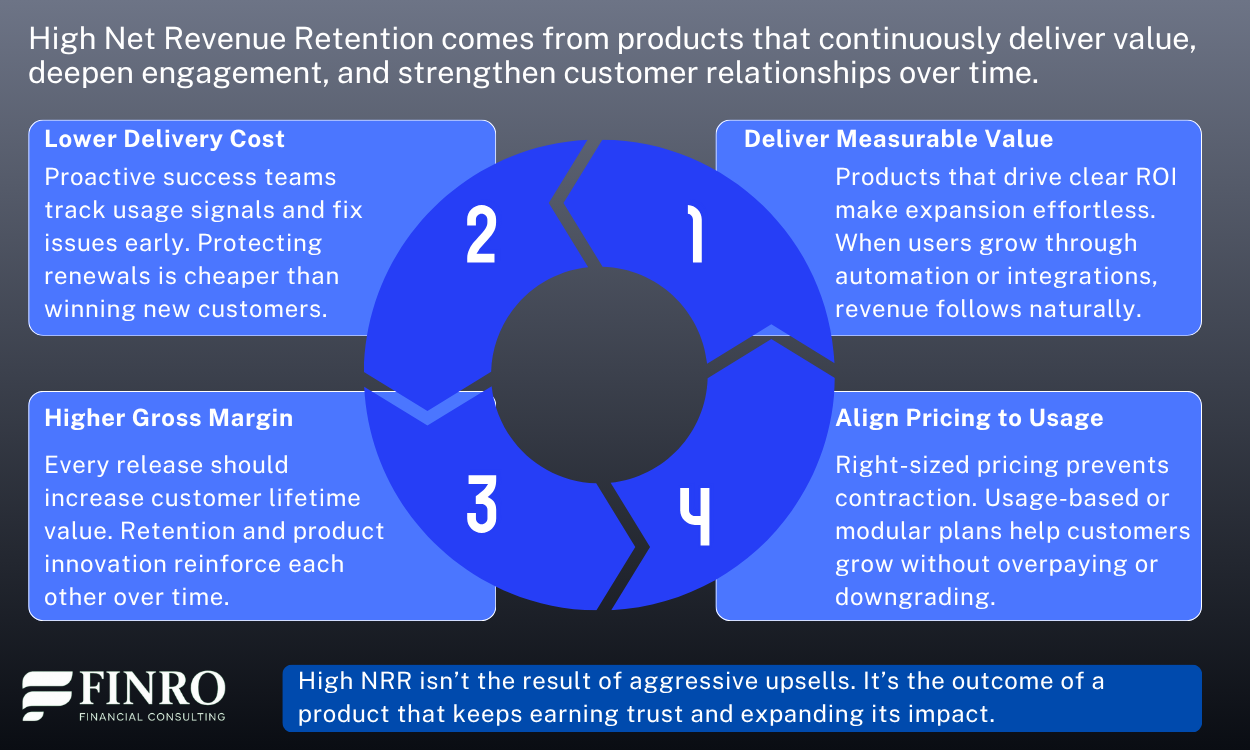

Improving NRR isn’t just about pushing upgrades or upsells. It’s about building a product that naturally expands in value over time. The best startups don’t chase expansion; they design it into their product, customer experience, and pricing.

Start with value, not discounts. When customers expand because they see measurable ROI, NRR compounds on its own. SaaS and API startups like Twilio and HubSpot grow retention by helping users automate, integrate, and scale their operations—not by offering short-term pricing incentives.

Contraction usually happens when customers pay for features they don’t need or struggle to use what they have. Fintech and PropTech platforms such as Ramp and Airbase address this by aligning pricing tiers with actual usage. They give customers room to grow without overcommitting, which keeps retention steady even when budgets tighten.

Preventing churn begins long before the customer decides to leave. Leading AI and cybersecurity companies track subtle signals like declining usage or unresolved tickets to predict attrition early. Datadog and Wiz, for example, turn customer success into a proactive engine that protects revenue well before renewal time.

Sustainable NRR growth also depends on creating long-term retention loops. Companies like Shopify and Coursera embed themselves into customers’ daily workflows, making their products essential rather than optional.

Each integration or community layer makes the business harder to leave, and more valuable to stay with.

Finally, product development should always connect to revenue outcomes. Every new feature should strengthen account value.

Whether it’s usage-based pricing in an API company or modular add-ons in a SaaS platform, the goal is the same: to make every customer relationship more valuable over time.

NRR Over Time: How It Evolves as Startups Mature

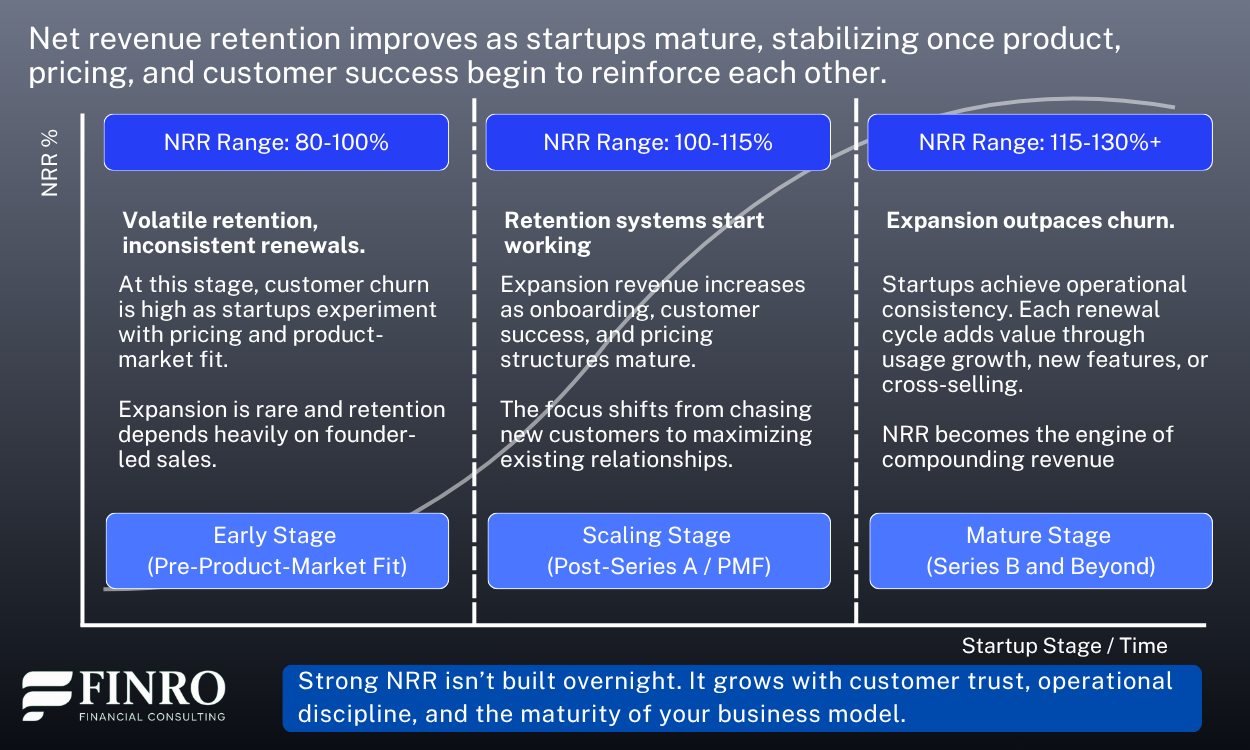

Net Revenue Retention changes as a startup grows.

In the early stages, it reflects more chaos than consistency. Some customers expand quickly, others churn faster than expected, and every new cohort looks different. That volatility is normal. It is not a sign of failure but a signal that your product, market, and pricing are still finding their balance.

As the company matures, NRR becomes a stronger indicator of product-market fit and operational discipline. Once sales cycles shorten, onboarding improves, and customers see faster time-to-value, expansion revenue starts to compound.

Growth becomes less about winning new logos and more about increasing value per existing account.

For SaaS and API-based startups, the turning point usually comes when usage-based pricing and automation align. Each new feature or integration deepens engagement and increases average revenue per account, lifting NRR into the 110–130 percent range.

For AI or infrastructure startups, it often takes longer, since high compute costs and complex onboarding can keep margins and retention lower until scale kicks in.

In later stages, strong NRR is the result of system design, not luck. Teams know exactly which accounts drive the majority of expansion and which need intervention to prevent churn.

Customer success, pricing, and product strategy are integrated into one growth engine. That is when NRR transforms from a metric into a business model, a self-sustaining loop of customer value and revenue growth.

NRR in Your Financial Model

Net Revenue Retention is more than a KPI for investors. It is a structural assumption that shapes every financial model. A realistic NRR assumption can turn an aggressive forecast into a credible one, while an inflated one can quietly destroy the model’s logic.

When modeling NRR, the most important principle is consistency. It must connect directly to customer cohorts, churn, and expansion revenue.

If your NRR is 120%, your forecast should clearly show where that 20% uplift comes from, whether through usage-based growth, cross-selling, or pricing updates. If there is no mechanism supporting it, the number is fiction.

In SaaS and API-based startups, NRR is often modeled by combining three assumptions:

Churn rate (percentage of customers or revenue lost each month),

Expansion rate (additional revenue from existing customers), and

Contraction rate (downgrades or lower usage).

The formula is simple:

NRR = (Starting MRR – Churn + Expansion – Contraction) ÷ Starting MRR

For example, if a company begins the month with $100,000 in recurring revenue, loses $5,000 in churn, gains $20,000 in expansion, and has $3,000 in downgrades, NRR equals:

(100,000 – 5,000 + 20,000 – 3,000) ÷ 100,000 = 112%

That 12% growth from the existing base is what makes investors confident that each dollar of revenue compounds over time.

Different sectors model NRR differently.

Fintech and AI companies often track revenue expansion per user, using product adoption or transaction volume as drivers.

Cybersecurity startups may model renewals by customer segment, since contract cycles and retention differ between SMB and enterprise.

EdTech or Marketplace startups can apply NRR logic to cohort revenue, tying it to engagement or repeat transactions.

NRR sits at the intersection of product and finance. When modeled well, it becomes the bridge between operational reality and valuation potential.

Summary

Net Revenue Retention is one of the most accurate indicators of a startup’s health and scalability. It shows whether existing customers are becoming more valuable or slipping away. In early stages, NRR fluctuates as startups test their market and pricing models. As the company matures, it reflects the combined strength of product, pricing, and customer success.

The best tech startups treat NRR as a growth system rather than a reporting metric — one that compounds over time as customers expand, adopt new features, and integrate deeper into the product.

At Finro, we help startups connect these operational dynamics to their financial models.

By structuring churn, expansion, and contraction in a defensible, investor-ready way, we turn metrics like NRR into valuation drivers that reflect real business performance.

Key Takeaways

1. NRR measures how efficiently revenue grows from existing customers.

2. Early volatility is normal as startups refine their product and pricing.

3. Strong NRR signals scalable operations and customer satisfaction.

4. Product, success, and pricing alignment drive expansion more than sales.

5. High NRR reflects long-term defensibility and valuation strength.

Answers to the Most Asked Questions

-

For SaaS and API startups, 110–130% is strong. Early-stage companies might fluctuate near 90–100% until retention systems stabilize.

-

Gross retention excludes expansion revenue, while NRR includes it. Gross retention shows stability; NRR shows compounding growth.

-

It reveals whether growth is sustainable. High NRR means customers expand over time, reducing dependence on new sales.

-

Use clear assumptions for churn, expansion, and contraction, tied to cohorts or usage data. NRR should reconcile with MRR movements.

-

Yes. Fintech, marketplace, and API companies can track NRR by revenue per user or transaction volume instead of subscriptions.